Table Of Content

Average home insurance premiums across the U.S. rose 7% in 2022, and about 9% in 2023, according to Insurify data. Inflation, natural disasters, and other factors are driving marketwide increases. Smoke detectors and fire extinguishers save lives and could save you money on your homeowners insurance. Personal Liability coverage protects against damage to others caused by you or members of your household, including most pets. With just a few clicks you can look up the GEICO Insurance Agency partner your insurance policy is with to find policy service options and contact information. Our experienced agents can help you with any paperwork and to manage your policy.

Will my homeowners insurance go up if my credit score goes down?

NJM has a streamlined online experience that allows you to easily manage the claims process. In addition, nonsmokers and people 65 and older may receive discounts on their premiums. Learn more about homeowners insurance, from understanding coverages to pricing information. Inflation can also affect the price of home insurance rates — if the price of labor and construction go up in your area, that means your house’s rebuild costs will also rise.

What is the cheapest homeowners insurance in California?

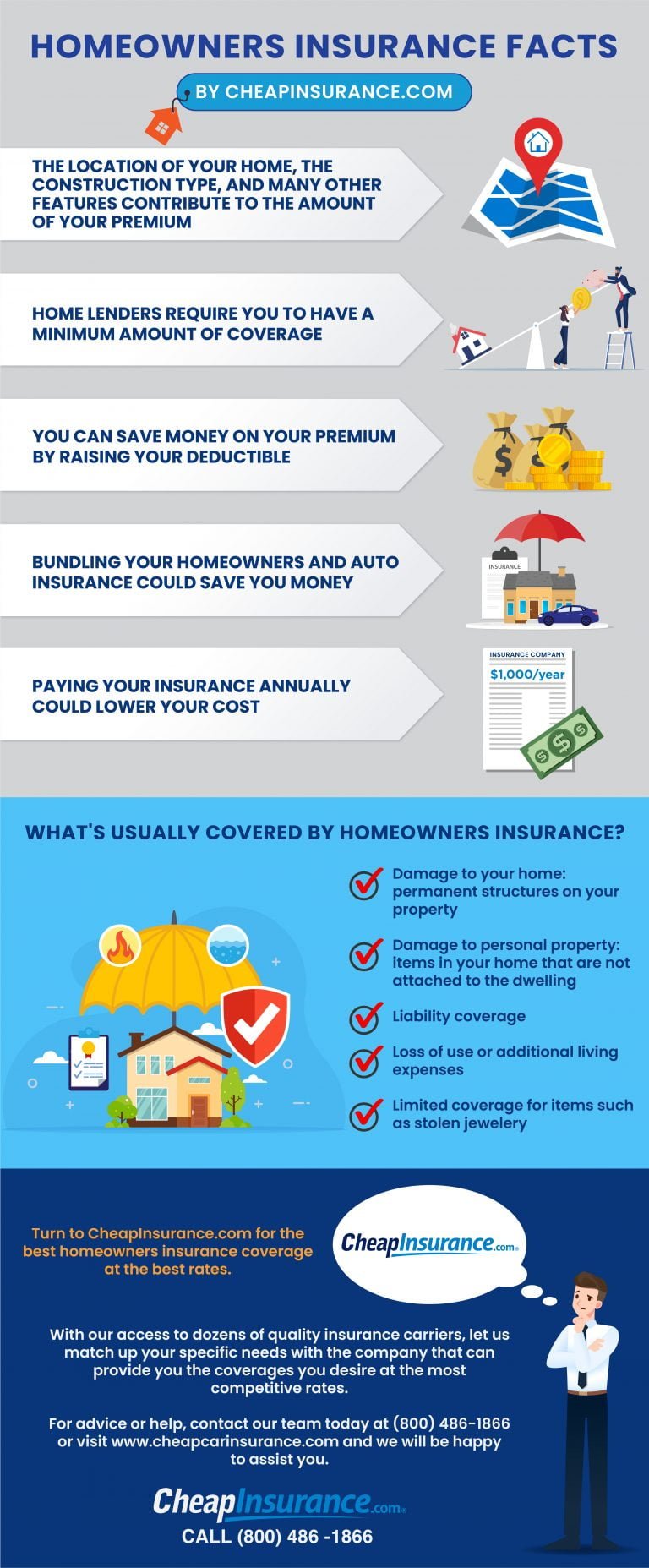

A standard home insurance policy (often called an HO-3) covers your house for any problem that’s not specifically excluded in your policy (such as earthquakes and floods). Some take a little more effort than others, but there are a variety of ways to get cheap home insurance for your property. Below are some of the most common ways to lower your homeowners insurance cost.

Claims and Roadside Help

Because each home insurance company uses its own valuation tool to determine the rebuilding cost of a home, it’s common to get quotes for slightly different dwelling amounts from different companies. Because many other home insurance coverage types default to a percentage of the dwelling amount, these coverage limits also vary between the quotes. To narrow down our list of the best homeowners insurance companies, we looked at customer complaint data, consumer experience and financial strength.

Compare the cheapest home insurance rates

That’s why it’s wise to get home insurance quotes from multiple companies. Even if you've never filed a claim, your insurance company may raise your rates for other reasons. Inflation and supply chain issues have made it more expensive to rebuild homes, which means it costs more for your insurance company to pay claims. Increasingly frequent disasters such as wildfires and hurricanes have also driven up the cost of insurance. In most states, poor credit generally translates to higher insurance costs, including for homeowners insurance. While not an overnight fix, you can restore credit by making payments on time and using less than 10% of your total credit card limits.

Best and Cheapest Home Insurance Rates in West Virginia - ValuePenguin

Best and Cheapest Home Insurance Rates in West Virginia.

Posted: Mon, 26 Feb 2024 08:00:00 GMT [source]

While home insurance quotes are a key factor in choosing a company, they shouldn’t be the only consideration. The best home insurance companies also offer good customer service and important coverage types like extended and/or guaranteed replacement cost coverage. We're the only homeowners insurance company that lets you compare home insurance quotes and coverages from multiple providers. Simply enter your information once, and we'll match you with a policy based on your input and frequently show additional options. Make sure you check with your insurance company to learn which discounts you qualify for and review your coverage limits annually. Travelers scored third-lowest in overall customer satisfaction in the 2023 J.D.

Based on our review of proprietary premium data from Quadrant Information Services, the national average rate of a homeowners policy with $300,000 in dwelling coverage is $2,151 annually. For homeowners looking to save a little money, it can be tempting to go with whichever company offers you the cheapest quote. However, cheap insurance is only worthwhile if it provides financial protection when you need it most. To find the best cheap companies, Bankrate analyzed vital metrics like third-party customer satisfaction scores, customer service availability, financial strength ratings and more. California residents have multiple insurers to choose from, several of which offer more affordable premiums for homeowners insurance than the state average. To help you find the best home insurance company for you, we calculated a Bankrate Score to analyze each company across several categories.

Lower limits usually mean lower rates but also that you have less financial protection. If you skimp on coverage to get a cheaper premium, you may regret it if you have to file a claim and find yourself facing high out-of-pocket costs. Working with an agent can provide you with peace of mind about your coverage decisions. The first thing you may notice, besides the differing premiums, is the different dwelling coverage amounts.

Amelia Buckley is an insurance editor for Bankrate, covering auto, home and life insurance. She emphasizes creating informative, engaging and nuanced content to support readers in making personalized insurance decisions with confidence. You may want to shop early, and end your old policy on the same date your new one starts to avoid a lapse in coverage. A coverage lapse could leave you and your home financially vulnerable and could raise your rates.

In general, you should expect a standard homeowners insurance policy to offer all six types of coverage. However, the level of coverage for each and the amount you can expect your insurer to pay in the event of a claim will vary from policy to policy. Most standard home insurance policies come with replacement cost dwelling coverage and actual cash value personal property coverage by default.

Then we break down the pros and cons to help consumers make the right decision for their needs. An optional add-on is its dwelling replacement coverage, which allows you to exceed your policy limits as necessary. In an era of unexpected shipping delays and fluctuating material costs, a little flexibility in rebuilding your home goes a long way. Amica Mutual also offers water backup, special computer coverage, personal property replacement coverage, and other riders to ensure the right coverage for future claims.

No comments:

Post a Comment